lake county real estate taxes indiana

The Federal Government has provided Coronavirus Local Fiscal Recovery Funds Recovery Funds through the American Rescue Plan Act ARPA to provide relief to local governmental units as a result of the COVID-19 Pandemic. The order contains the states certification of the approved budget the certified net assessed value the tax rate and the levy for each fund of each taxing unit in a county.

13 5 Acres Located On Beautiful Salem Ridge This Ranch Home Sits Off The Road And Has A Ton Of Privacy First Ti Indiana Real Estate Home Warranty Ranch House

Lake County Assessor OUR MISSION To produce fair and equitable assessments of all taxable real estate using both proven and innovative methods while delivering exceptional service to the public.

. The collection begins on November 1st for the current tax year of January through December. Zillow has 16772 homes for sale. For Sale - 0 Lake Shore County Road Beverly Shores Indiana 46301 MLS 509888 is a 480000 00 bath vacant land property.

These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. Lake County collects on average 137 of a propertys assessed fair market value as property tax. It may not reflect the most current information pertaining to the property of interest.

2022 Lake County Budget Order - Issued January 13 2022. Property taxes in Indiana are overseen by the Indianas Department of Local Government Finance and administered and collected by local government officials and represent a primary source of funding for local government units including counties. The order also gives the total tax rate for each taxing district.

Your Indiana Adjusted Gross Income AGI is less than 18600. Lake Countys average tax rate is 137 of a propertys assessed market value which is higher than Indianas average property tax rate of 085. Welcome to the Lake County Assessors citizen engagement site.

Its Fast Easy. We are proud to offer this service at no cost to our constituents. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment.

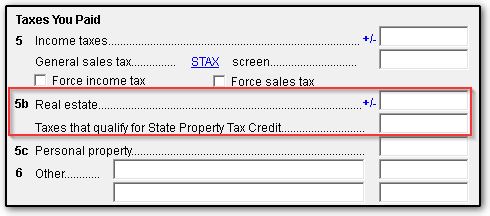

You paid property tax to Lake County Indiana on your residence. Tax amount varies by county. View listing photos review sales history and use our detailed real estate filters to find the perfect place.

As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks. See detailed property tax information from the sample report for 2792 Cypress Ln Lake County IN. Lake County has one of the highest median property taxes in the United States and is ranked 540th of the 3143 counties in order of median property taxes.

You can expect to pay around 1852 in property taxes per year based on the Indiana Lake County average. Your Modified Indiana Adjusted Gross Income is less than 18600. 085 of home value.

The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400. Download a Full Property Report with Tax Assessment Values More. These fees are not retained by Lake County and therefore are not refundable for any reason.

You paid property tax to Lake County Indiana on your residence. You must either own or be buying the residence under contract and must pay property tax to Lake County Indiana on that residence. Property Tax Rates in Lake County IN Property Tax Rates in State.

Treasury Department the. Remember you can claim either the Lake County Indian Residential credit OR the. School districts get the biggest portion about 69 percent.

Main Street Crown Point IN 46307 Phone. Ad View County Assessor Records Online to Find the Property Taxes on Any Address. You may be eligible to claim a Lake County Indiana residential income tax credit if you meet ALL THREE of the following requirements.

Your residence is your principal dwelling. The median property tax in Indiana is 105100 per year for a home worth the median value of 12310000. Please note there is a nomimal convenience fee charged for these services.

All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy. IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. Counties in Indiana collect an average of 085 of a propertys assesed fair market value as property tax per year.

2021 Lake County Budget Order AMENDED - Issued. Lake County Indiana - 2021 Recovery Plan Performance Report. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts.

Over 1 Acres of stunning building. These fees are not retained by Lake County and therefore are not refundable. Discover Lake County Indiana Treasurer for getting more useful information about real estate apartment mortgages near you.

Valparaiso Indiana Home Sold Above List Price 46383 Valparaiso Indiana Valparaiso Indiana

Pa S Unfair Tax System Drives Residents Out Of Homes And Out Of State Opinion Pennlive Com

Waupaca County Wi Asylum For The Chronic Insane Circa 1902 Abandoned Asylums Asylum Abandoned Places

6677 N Shuffle Creek Road Indiana Real Estate Real Estate Ranch House

2 Of My Reasons Why Realestate Preservation Propertyflipping Mompreneur Property Flipping Investment Property Real Estate

Ever Wondered If 3466 Square Feet Would Be A Good Fit Listing Jeanette Thedifferenceisinthedetails House Tours House Styles Hvac Heat Pump

8784 South Slevins Drive Lakefront New Deck Lake Toys

How To Compute Real Estate Tax Proration And Tax Credits Illinois

The Woodmere Neighborhood Valparaiso Indiana 46383 Valparaiso Indiana The Neighbourhood Valparaiso

Indiana Property Tax Calculator Smartasset

12 South Jefferson Street Indiana Real Estate Jefferson Street Real Estate

Beachwalk Resort Community Homes Sold By F C Tucker Beach Walk Resort Michigan City

Finding A Home For Our Buyer When Inventory Is Low Finding A House Things To Sell Beautiful Flowers

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Michigan Property Tax H R Block

Home Page Real Estate Investor Real Estate Investing Cash Buyers